阅读:0

听报道

《黑天鹅》作者教育美国大学毕业生:“贪婪和恐慌是伟大的导师”;“在华尔街游戏中节操还是要有的”(外媒精选-英文)

精选外媒趣闻,由于时间因素,暂不翻译。

微信号:卖呆儿

目录:

投行伯恩斯坦:为何苹果公司的卖点应转向生活方式,而非又一部iPhone(businessinsider)

橡树资本创始人马科斯剖析“美国政客经济药方”的不可行性

马科斯:美国不可能和中国竞争制造业岗位,中国有杀手锏:不买美国国债。

IMF学者报告:里根、克林顿、撒切尔引领的新自由主义或是彻底失败

高盛:炒A股必须盯紧PMI

特斯拉中国若建厂,谁将受益?野村看好四股

中国人狂买比特币,借道资本外逃?

美银美林:美股没有将美联储6月或7月升息计价

富国:美联储6月升息是否成为现实可能,看下周三项关键数据指标

《黑天鹅》作者毕业致辞:“贪婪和恐慌是伟大的导师”;“在华尔街游戏中节操还是要有的”

投行伯恩斯坦:为何苹果公司的卖点应转向生活方式,而非又一部iPhone(businessinsider)

Why Apple needs to sell a lifestyle, not another iPhone

Apple critics often scoff that when people buy a MacBook or an iPhone, they aren't really buying a gadget as much as they are buying into the "Apple lifestyle."

But that might not be such a bad thing for the company moving forward, according to analysts at Bernstein.

Here's Apple’s problem, as it stands: It makes the bulk of its money by selling hardware on a renewal cycle, and that makes it vulnerable if people start replacing their iPhones less often.

"iPhone amounts to nearly 70% of total company profits today, and over time, the smartphone market will invariably saturate," the analysts wrote in a note on Friday. "Apple will no longer be able to gain share, and the iPhone business will become a replacement market." That problem worsens if those replacement cycles get longer.

The analysts' solution to this is simple: Make "Apple," in a broad sense, a subscription.

Apple is already pushing toward this with its "iPhone upgrade program," in which users pay a certain amount per month to get a new phone every year. But the analysts are thinking bigger. They seeing you paying a monthly fee for access to the Apple lifestyle, which means an iPhone and an iPad and access to Apple Music and iCloud, and so on.

The analysts think this a good idea for a few reasons. First, consumers have become increasingly accustomed to paying monthly bills for things like Netflix, Spotify, internet, and cable (and more). And second, "smartphones (even on the high end) are relatively inexpensive on a cost per use basis when compared to other services for which customers willingly pay." That means that when you break owning a smartphone down into smaller units, it appears more affordable, because you get a sense of your true use.

Here's how the analysts explain that second point:

For example, a Starbucks customer may pay $3.65 every morning for a grande latte (a figure which few would find shocking), yet this is more than 3x as expensive a habit as iPhone hardware use. Given the $700 price tag on an iPhone 6S and a replacement cycle of 2+ years, iPhone users pay less than $1per day for the device – seemingly a relative bargain. Even if we account for the additional daily cost of wireless service (perhaps $30-60/month or $1-$2/day), the total cost of owning and using an iPhone (~$3/day) is less expensive than buying name-brand coffee every morning.

Given this, the analysts think Apple could put together a package that consumers would find appealing from a price point.

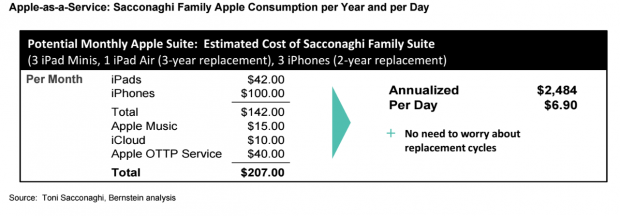

Here's what the analysts think an "Apple family plan" might look like (the OTTP plan is a potential "skinny bundle" TV replacement, streaming service priced at $40):

下面,我的偶像马科斯出现了,我的偶像还有冈拉克。

橡树资本创始人马科斯剖析“美国政客经济药方”的不可行性

He ran through eight current policies and proposals set forth by the government and their failures to adhere to the basics of economics. They were:

Central Bank monetary stimulus: Marks argues that the repeated stimulus from the Fed has become ineffective because such actions were designed only to jump-start an economy, not sustain it. "In the old days, when cars often failed to start, there were fluids we could squirt into the carburetor to get them going. But they weren't fuel for long-term operation," he said.

Increasing entitlements and benefits: The idea that simply increasing government programs will increase well-being and productivity makes no sense to Marks. "Governments can't create out of thin air the means with which to make disbursements," he wrote.

Raising taxes: Higher taxes, in Marks' opinion, restrict the flow of money throughout the country's system and prevents upward mobility. Additionally, in a more practical sense, if you raise taxes, then people can just move anyway.

Printing money: Simply put, just because you print more money and get it flowing in the economy, doesn't mean that people are any better off. "They can increase people's nominal incomes, but eventually they'll find their fatter wallets don't contain any more spending power than they used to," said Marks.

Currency devaluation: Marks notes that devaluation makes goods created at home only more expensive and does nothing to help the underlying economy. Additionally, currency devaluation doesn't work if multiple countries are engaged in the practice.

Tariffs: The idea that you can "bring back jobs" isn't viable without tariffs and raising prices for all Americans. "In this globalized world, that means Americans can't enjoy both the high-paying manufacturing jobs they used to have and the low-cost goods they've been buying of late," he wrote. "The imposition of tariffs can't solve that conundrum."

Higher minimum wage: While Marks doesn't write off the idea of a higher minimum wage entirely, he does think that it will affect business investment and lead to job losses. "It seems unlikely that you can make everyone better off just by mandating a higher wage," said Marks.

Redistribution of wealth: Marks takes issues with Democratic presidential candidate Bernie Sanders' idea of central-government economic control through regulation and taxation of businesses. Marks cites the case of Venezuela's economic and political meltdown as an example of how this does not work.

马科斯:美国不可能和中国竞争制造业岗位。分析中特别提到中国杀手锏:不买美国国债。

First, Marks points out that US manufacturing output is near an all-time high, even though US manufacturing employment is down 37% from the peak in 1979. In other words, productivity has increased.

"So while we’ve lost 3.2 million jobs to China since 2001, for example, we've lost many times that to improvements in productivity. Perhaps if the government wants to preserve jobs it should just outlaw productivity gains," he quipped.

He then points out some of the practical difficulties with bringing back the jobs. Consider the following example:

Let's assume it's possible to manufacture high-labor-content goods like cellphones much more cheaply in China than in the U.S. (not an unreasonable assumption, since the average manufacturing worker in China makes less than $9,000 per year). And let's assume the resulting cost to deliver a cellphone to an American retailer is $100 if made in China versus $150 if made in the U.S. In that case, a Trump or Sanders administration would have the following choices:

forbid imports of cellphones, requiring that they be made in the U.S. at a cost of $150,

find Americans willing to work at Chinese wages, bringing the cost down to $100, or

impose a trade tariff on Chinese imports that equalizes the U.S. retailer's cost for phones at $150.

Marks doesn't see the first solution as feasible. The second is equally unlikely, he said, citing the tedious nature of the work involved and violation of the US federal minimum wage. That leaves us with tariffs, but Marks notes there are simply too many problems with this option:

Such tariffs are probably barred under trade agreements that are in place. To impose them, we would have to break those agreements.

We have to wonder about retaliatory actions — wouldn't other countries impose offsetting tariffs on U.S. exports that would further harm our manufacturing base? As The New York Times wrote on May 3, "starting a trade war might be cathartic for workers who have lost jobs, but it is unlikely to create a lot of factory work."

What would happen to our ability to refinance our perpetually growing national debt if China, our biggest creditor, decided one day it wasn't quite as eager to participate in new Treasury financings?

What would rising trade barriers do to one of the main motivations behind the broadening of U.S. trade agreements since World War II: preventing conflict?

Finally, but most simply, what American wants to pay 50% more for a cellphone than they do today?

“Do we want to subsidize our farmers, or do we want to allow Americans to buy cheap crops from abroad (and let the farmers go out of business)? Leaving aside strategic national considerations, do we want to protect the jobs of those who work in industries where the U.S. is uncompetitive, or do we want to allow U.S. consumers as a whole to minimize their cost of living? In each case, it's one or the other ... but not both.”

备忘录链接:

IMF学者报告:里根、克林顿、撒切尔引领的新自由主义或是彻底失败。

既经济向境外资本开放,同时降低政府债务负担,这是过去30年经济政策制定的主趋势。报告称,这些目标既阻碍了其所力求的经济增长,又加剧了不平等的抬头。

IMF: The last generation of economic policies may have been a complete failure(BI)

The International Monetary Fund thinks all that neoliberalism might've been too much of a good thing.

Neoliberalism — which IMF researchers Jonathan Ostry, Prakash Loungani, and Davide Furceri loosely define as the opening of economies to foreign capital along with a reduction in government debt burdens — has been the dominant trend in economic policymaking over the past 30 years.

This broad framework for thinking about economic policy encourages increasing privatization of investment and a reduced capacity for government's to rack up debts in the pursuit of faster growth.

The policies of Ronald Reagan and Bill Clinton in the US and Margaret Thatcher in the UK are often held up as the gold standard of neoliberalism at work.

But now it seems some at the IMF aren't so sure this tradition is all it's been cracked up to be. In their paper, Ostray, Loungani, and Furceri argue that these goals have both hampered the economic growth that neoliberalism champions and exacerbated the rise of inequality.

The pursuit of neoliberal policies, the IMF argues, by the international economic and political elite has led to what they call "three disquieting conclusions."

The benefits in terms of increased growth seem fairly difficult to establish when looking at a broad group of countries.

The costs in terms of increased inequality are prominent. Such costs epitomize the trade-off between the growth and equity effects of some aspects of the neoliberal agenda.

Increased inequality in turn hurts the level and sustainability of growth. Even if growth is the sole or main purpose of the neoliberal agenda, advocates of that agenda still need to pay attention to the distributional effects.

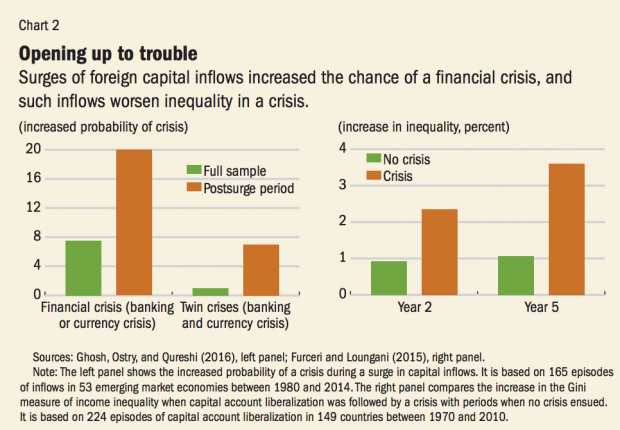

According to Ostray, Loungani, and Furceri, an increased liberalization of a country's capital account — how easy it is for foreign investors to move money in and out of the country — appears to put countries more at risk for a financial crisis and may not aid growth as much as advertised.

"The link between financial openness and economic growth is complex," they write.

Adding:

"Some capital inflows, such as foreign direct investment—which may include a transfer of technology or human capital—do seem to boost long-term growth. But the impact of other flows—such as portfolio investment and banking and especially hot, or speculative, debt inflows—seem neither to boost growth nor allow the country to better share risks with its trading partners ... Since 1980, there have been about 150 episodes of surges in capital inflows in more than 50 emerging market economies; as shown in the left panel of Chart 2, about 20 percent of the time, these episodes end in a financial crisis, and many of these crises are associated with large output declines."

So this outline basically says countries that take in certain types of speculative flows get only some of the benefits of this money coming in while assuming all of the risks.

高盛:炒A股必须盯紧PMI

财新PMI,给东家做个广告

Goldman’s China Musings: Should Equity Investors Look At PMIs?(巴伦周刊)

For many investors, China’s macro cyclical movements have been difficult and confusing to read. The iShares MSCI China ETF (MCHI) had a strong two-month recovery from its mid-February low, only to lose most of its gains in May. We are seeing a slight up-tick again this week.

MSCI China’s performance is linked to high-frequency macro data. Investors were encouraged by strong data points in March, sparking debates about “green shoots” in China, but April data turned out to be disappointing, leading to selling in May.

According to Goldman Sachs, equity investors must look at China’s monthly PMI data carefully. China PMI data account for 18% of the index weight for Goldman’s proprietary Current Activity Index, which the bank views as a superior measure of the Chinese economy than the official GDP.

Kinger Lau and team wrote:

We see PMIs offering 3 key advantages over other alternatives: a) we believe they are a reasonable proxy for the underlying economy, and the manufacturing sector in particular; b) they correlate well with offshore equity market returns; and c) they are released much earlier than other popular official statistics.

Between the official National Bureau of Statistics’ PMI, which polls larger companies, and Caixin PMI, Goldman would go for the official number:

Among various PMIs, we believe investors should focus on the NBS manufacturing PMI as it shows the highest correlation with equity returns, although the relationship is coincident as opposed to leading as many perceive.

Specifically, the correlation coefficient between the official PMI and MSCI returns is over 45%, versus less than 40% for Caixin PMI. This is not surprising, considering the MSCI benchmark has a ton of state-owned enterprises.

Having said that, PMI data is by nature backward-looking. For instance, we will only see the May PMI numbers on June 1. So the more useful and forward-looking data for equity investors would reside in the sub-PMI indexes, such as Production and Business Expectation, Finished Goods Inventory and Purchasing Price Index. These sub-indexes are forward-looking:

It is worth noting that the month-on-month change in Production and Business Expectation has correctly predicted the subsequent-month market direction in 8 occasions over the past 12 months, and 9 out of 12 for Finished Goods Inventory.

特斯拉中国若建厂,谁将受益?野村看好四股

Who Will Benefit From A Tesla China Factory?(巴伦周刊)

There have been rumors that Tesla (TSLA) might open a factory in China.

Tesla CTO JB Straubel said it would make sense for Telsa to build a factory there when local demand reaches a “critical mass” and last year, Elon Musk suggested a China factory could happen around 2019.

Why would Tesla want to build a factory in China?

To avoid import tariffs and taxes and enjoy government subsidies. Local production would allow Tesla to sell its cars more cheaply, because it can avoid 25% import tariffs and 17% VAT.

Second, to regain momentum in the China market. The final price of the Model S in China is 48% higher than in the US, largely because of the taxes. As a result, Tesla sales in China tumbled 33.5% in 2015 and for 2016, the electric car maker already halved its sales target to only 5,000 cars versus 10,000 in 2015. A locally produced Model 3 could cost under 300,000 yuan (roughly $46,000), competitive against Chinese market leader BYD‘s (1211.Hong Kong) flagship Qin model, estimates Nomura Securities.

However, the devil is in the details. Tesla will need to find a local partner to build a joint venture, due to regulatory constraints.

But if Tesla is making progress, these stocks can benefit, according to Nomura’s Leping Huang:

Sunny Optical (2382.Hong Kong, Buy, providing vehicle lens), Joyson (600699 CH,NR, BMS sensors/passive safety), Wuhu Token Science (300088 CH, NR, touch panels) and Navinfo (002405 CH, NR, maps) have already penetrated Tesla’s supply chain.

中国人狂买比特币,借道资本外逃?(零对冲)

Bitcoin Is Soaring On Unprecedented Burst In Chinese Buying

It looks like the Chinese have finally awoken to bitcoin, just as we expected them to last September, when the price of bitcoin was over 50% lower.

With bitcoin now 100% higher than when we first said China would send it soaring,and 15% higher in the past two days, why do we remain in the bullish camp? Simple: China has $30 trillion in deposits - which concerns about devaluations will make very "flighty" while the market cap of bitcoin is under $8 billion. If Chinese depositors have finally figured out to use bitcoin to get their funds out of the country, watch out BTC shorts.

美银美林:美股没有将美联储6月或7月升息计价

银行保险等‘鹰派行业’行业估值仍低,不动产投资信托、公共事业等‘鸽派”板块估值仍高。(路透)

However, stocks have not yet priced in a rate hike in June or even July, according to analysts at Bank of America/Merrill Lynch.

"The vast majority of 'hawkish' industries (which have outperformed when rate hikes have been pulled forward by the market) are still cheap, while most 'dovish' industries (which have outperformed when rate hikes have been pushed out) are still expensive," the bank's analysts said in a Friday note.

They list consumer finance, banks and insurance among industries that appear cheap while beverages, real estate investment trusts and electric utilities still rank as expensive even though they benefit from policy the Fed seems to be walking away from.

Financials led the way on the S&P 500 on Friday. If next week's data continues to point to a hike from the Fed, banks will likely continue to outperform, as higher interest rates mean increased returns for lending, the core of their business.

Shares in the utilities sector <.splrcu> were the laggard of the week and could continue to be if investors see a hawkish slant at the Fed. With a dividend yield of 3.5 percent, the sector is mostly favored when rates are expected to remain lower for longer.

富国银行分析师:美联储6月升息是否成为现实可能,看下周三项关键数据指标

非农制造业工作周数据、褐皮书薪资压力、ISM制造业数据私营领域新订单数据。(路透)

The Fed's favorite inflation gauge, personal consumption expenditures, is due on Tuesday and is expected to show a 0.2 percent monthly increase for April. Non-farm payrolls data due on Friday is expected to show the U.S. economy created 164,000 jobs in May.

Besides the big inflation and jobs data, the Fed will get its own numbers out, with the Beige Book of anecdotal information of current economic conditions out Wednesday.

Though the probability of all data pointing in the same direction is small, a chance of an increase in the manufacturing work-week numbers in the payrolls report, a broad build-up of wage pressure in the Beige Book and a strong reading in the new orders component of the private-sector ISM manufacturing data out Wednesday are key to determining the Fed's next move, according to Brian Jacobsen, chief portfolio strategist at Wells Fargo Asset Management in Menomonee Falls, Wisconsin.

"Those three things could line up to make (a rate hike in)June a real possibility," he said.

《黑天鹅》作者告诉美国大学毕业生:“贪婪和恐慌是伟大的导师”;“在华尔街游戏中必须要有节操”。

"Greed & Fear Are Great Teachers" Black Swan Author Tells Graduates "Always Have Skin In The Game"(零对冲)

Outspoken author and fund manager Nassim Taleb gave his first commencement speech at the American University in Beirut, offering advice on judging success, the importance of self-respect, what greed and fear can teach, the uselessness of nonsense, and the importance of having skin the game with every decision one makes...

This is the first commencement I have ever attended (I did not attend my own graduation). Further, I have to figure out how lecture you on success when I do not feel successful yet –and it is not a false modesty.

Success as a Fragile Construction

For I have a single definition of success: you look in the mirror every evening, and wonder if you disappoint the person you were at 18, right before the age when people start getting corrupted by life. Let him or her be the only judge; not your reputation, not your wealth, not your standing in the community, not the decorations on your lapel. If you do not feel ashamed, you are successful. All other definitions of success are modern constructions; fragile modern constructions.

The Ancient Greeks’ main definition of success was to have had a heroic death. But as we live in a less martial world, even in Lebanon, we can adapt our definition of success as having taken a heroic route for the benefits of the collective, as narrowly or broadly defined collective as you wish. So long as all you do is not all for you: secret societies used to have a rule for uomo d’onore: you do something for yourself and something for your other members. And virtue is inseparable from courage. Like the courage to do something unpopular. Take risks for the benefit of others; it doesn’t have to be humanity, it can be helping say Beirut Madinati or the local municipality. The more micro, the less abstract, the better.

Success requires absence of fragility. I’ve seen billionaires terrified of journalists, wealthy people who felt crushed because their brother in law got very rich, academics with Nobel who were scared of comments on the web. The higher you go, the worse the fall. For almost all people I’ve met, external success came with increased fragility and a heightened state of insecurity. The worst are those "former something" types with 4 page CVs who, after leaving office, and addicted to the attention of servile bureaucrats, find themselves discarded: as if you went home one evening to discover that someone suddenly emptied your house of all its furniture.

But self-respect is robust –that’s the approach of the Stoic school, which incidentally was a Phoenician movement. (If someone wonders who are the Stoics I’d say Buddhists with an attitude problem, imagine someone both very Lebanese and Buddhist). I’ve seen robust people in my village Amioun who were proud of being local citizens involved in their tribe; they go to bed proud and wake up happy. Or Russian mathematicians who, during the difficult post-Soviet transition period, were proud of making $200 a month and do work that is appreciated by twenty people –and considered that showing one’s decorations –or accepting awards –were a sign of weakness and lack of confidence in one’s contributions. And, believe it or not, some wealthy people are robust –but you just don’t hear about them because they are not socialites, live next door, and drink Arak baladi not Veuve Cliquot.

Personal History

Now a bit of my own history. Don’t tell anyone, but all the stuff you think comes from deep philosophical reflection is dressed up: it all comes from an ineradicable gambling instinct –just imagine a compulsive gambler playing high priest. People don’t like to believe it: my education came from trading and risk taking with some help from school.

I was lucky to have a background closer to that of a classical Mediterranean or a Medieval European than a modern citizen. For I was born in a library –my parents had an account at Librarie Antoine in Bab Ed Driss and a big library. They bought more books than they could read so they were happy someone was reading the books for them. Also my father knew every erudite person in Lebanon, particularly historians. So we often had Jesuit priests at dinner and because of their multidisciplinary erudition they were the only role models for me: my idea of education is to have professors just to eat with them and ask them questions. So I valued erudition over intelligence –and still do. I initially wanted to be a writer and philosopher; one needs to read tons of books for that –you had no edge if your knowledge was limited to the Lebanese Baccalaureat program. So I skipped school most days and, starting at age 14, started reading voraciously. Later I discovered an inability to concentrate on subjects others imposed on me. I separated school for credentials and reading for one’s edification.

First Break

I drifted a bit with no focus, and remained on page 8 of the Great Lebanese Novel until the age of 23 (my novel was advancing one page per year). Then I got a break on the day when at Wharton I accidentally discovered probability theory and became obsessed with it. But, as I said it did not come from lofty philosophizing and scientific hunger, only from the thrills and hormonal flush one gets while taking risks in the markets. A friend had told me about complex financial derivatives and I decided to make a career in them. It was a combination of trading and complex mathematics. The field was new and uncharted. But they were very, very difficult mathematically.

Greed and fear are teachers. I was like people with addictions who have a below average intelligence but were capable of the most ingenious tricks to procure their drugs. When there was risk on the line, suddenly a second brain in me manifested itself and these theorems became interesting. When there is fire, you will run faster than in any competition. Then I became dumb again when there was no real action. Furthermore, as a trader the mathematics we used was adapted to our problem, like a glove, unlike academics with a theory looking for some application. Applying math to practical problems was another business altogether; it meant a deep understanding of the problem before putting the equations on it. So I found getting a doctorate after 12 years in quantitative finance much, much easier than getting simpler degrees.

I discovered along the way that the economists and social scientists were almost always applying the wrong math to the problems, what became later the theme of The Black Swan. Their statistical tools were not just wrong, they were outrageously wrong –they still are. Their methods underestimated "tail events", those rare but consequential jumps. They were too arrogant to accept it. This discovery allowed me to achieve financial independence in my twenties, after the crash of 1987.

So I felt I had something to say in the way we used probability, and how we think about, and manage uncertainty. Probability is the logic of science and philosophy; it touches on many subjects: theology, philosophy, psychology, science, and the more mundane risk engineering –incidentally probability was born in the Levant in the 8th Century as 3elm el musadafat, used to decrypt messages. So the past thirty years for me have been flaneuring across subjects, bothering people along the way, pulling pranks on people who take themselves seriously. You take a medical paper and ask some scientist full of himself how he interprets the "p-value"; the author will be terrorized.

The International Association of Name Droppers

The second break came to me when the crisis of 2008 happened and felt vindicated and made another bundle putting my neck on the line. But fame came with the crisis and I discovered that I hated fame, famous people, caviar, champagne, complicated food, expensive wine and, mostly wine commentators. I like mezze with local Arak baladi, including squid in its ink (sabbidej), no less no more, and wealthy people tend to have their preferences dictated by a system meant to milk them.

My own preferences became obvious to me when after a dinner in a Michelin 3 stars with stuffy and boring rich people, I stopped by Nick’s pizza for a $6.95 dish and I haven’t had a Michelin meal since, or anything with complex names. I am particularly allergic to people who like themselves to be surrounded by famous people, the IAND (International Association of Name Droppers). So, after about a year in the limelight I went back to the seclusion of my library (in Amioun or near NY), and started a new career as a researcher doing technical work. When I read my bio I always feel it is that of another person: it describes what I did not what I am doing and would like to do.

On Advice and Skin in the Game

I am just describing my life. I hesitate to give advice because every major single piece of advice I was given turned out to be wrong and I am glad I didn’t follow them. I was told to focus and I never did. I was told to never procrastinate and I waited 20 years for The Black Swan and it sold 3 million copies. I was told to avoid putting fictional characters in my books and I did put in Nero Tulip and Fat Tony because I got bored otherwise. I was told to not insult the New York Times and the Wall Street Journal; the more I insulted them the nicer they were to me and the more they solicited Op-Eds. I was told to avoid lifting weights for a back pain and became a weightlifter: never had a back problem since.

If I had to relive my life I would be even more stubborn and uncompromising than I have been.

One should never do anything without skin in the game. If you give advice, you need to be exposed to losses from it. It is an extension to the silver rule. So I will tell you what tricks I employ.

Do not read the newspapers, or follow the news in any way or form. To be convinced, try reading last years’ newspaper. It doesn’t mean ignore the news; it means that you go from the events to the news, not the other way around.

If something is nonsense, you say it and say it loud. You will be harmed a little but will be antifragile – in the long run people who need to trust you will trust you.

When I was still an obscure author, I walked out of a studio Bloomberg Radio during an interview because the interviewer was saying nonsense. Three years later Bloomberg Magazine did a cover story on me. Every economist on the planet hates me (except of course those of AUB).

I’ve suffered two smear campaigns, and encouraged by the most courageous Lebanese ever since Hannibal, Ralph Nader, I took reputational risks by exposing large evil corporations such as Monsanto, and suffered a smear campaign for it.

Treat the doorman with a bit more respect than the big boss.

If something is boring, avoid it –save taxes and visits to the mother in law. Why? Because your biology is the best nonsense detector; use it to navigate your life.

The No-Nos

There are a lot of such rules in my books, so for now let me finish with a maxim. The following are no-nos:

Muscles without strength,

friendship without trust,

opinion without risk,

change without aesthetics,

age without values,

food without nourishment,

power without fairness,

facts without rigor,

degrees without erudition,

militarism without fortitude,

progress without civilization,

complication without depth,

fluency without content,

and, most of all, religion without tolerance.

话题:

0

推荐

财新博客版权声明:财新博客所发布文章及图片之版权属博主本人及/或相关权利人所有,未经博主及/或相关权利人单独授权,任何网站、平面媒体不得予以转载。财新网对相关媒体的网站信息内容转载授权并不包括财新博客的文章及图片。博客文章均为作者个人观点,不代表财新网的立场和观点。

京公网安备 11010502034662号

京公网安备 11010502034662号